Traveling should be all about exploration, adventure, and making amazing memories. However, unforeseen events like being hospitalised in Vietnam can throw a huge wrench in your plans!

This is why travel insurance is an absolute MUST while long term travelling – you just really don’t know when something will go wrong. We use HeyMondo as our travel insurance provider, and have had a great experience with them. This post isn’t sponsored, we just had a great experience using HeyMondo. Below is a detailed post on everything you need to know about travel insurance.

WHY HEYMONDO?

We reviewed many different travel insurance providers, and eventually settled on HeyMondo for a few reasons:

- HeyMondo provides “long stay” coverage for people like us who are full time travellers and don’t necessarily know where we’ll be in a few weeks!

- Unlike some other providers, they also provide coverage in our “home countries”, which in our case is Canada and the US. We don’t have to worry about our insurance lapsing when we go back home to visit friends and family.

- Their pricing is very competitive, at just $45 USD/month/person.

TYPES OF INSURANCE

HeyMondo provides 3 different types of insurance:

- Heymondo Single Trip Insurance: This is comprehensive travel insurance for domestic and international travel of less than 90 days

- Heymondo Annual Insurance: This is travel insurance for multiple trips per year, as long as each trip is less than 90 days and you return to your place of residence. This type of insurance is great for travellers that go on a couple big trips per year.

- HeyMondo Long-Stay Insurance: This is what we use! It’s travel insurance for all trips throughout the year without needing to return to a “home base”. This is the perfect insurance for full time travellers or digital nomads who live life on the road.

WHAT DO THEY COVER?

Heymondo offers a range of coverage options, from medical emergencies to trip cancellations, ensuring you’re protected against a wide range of travel-related issues.

My policy has a $250 USD deductible and the coverage includes:

Emergency medical & dental expenses overseas of up to $2,500,000 USD

- While some countries have fairly affordable health care, others such as the US have absolutely staggering medical fees, so it’s better safe than sorry!

Medical transportation & repatriation home

- This is a huge one that is often overlooked until it’s too late – an emergency helicopter or private plane to evacuate you from a remote location could easily cost 6 figures.

Baggage delay and damage insurance of up to $1200 USD

- This coverage helps in situations where your luggage is delayed, lost, or damaged while travelling

Travel delay coverage up to $350 USD

- This includes reimbursement if you miss your connecting flight, so it’s a great little benefit to have if you extenuating circumstances arise.

You can also opt in to insure your electronics against theft/damage, or opt into their “adventure sports” insurance to protect yourself if you plan on doing more risky activities such as white water rafting, canyoneering etc.

OTHER BENEFITS

Direct Medical Payments: One of the main reasons why we chose HeyMondo was their Direct Medical Billing Policy. After you are injured or ill, you can contact the HeyMondo 24-hour Assistance telephone number, where they will assign you a local partner and direct you to the nearest hospital/clinic. If you get your hospital referred through HeyMondo, you will not have to pay any expenses (other than your deductible) at the hospital or outpatient centre, since the HeyMondo will work with the hospital’s billing team directly.

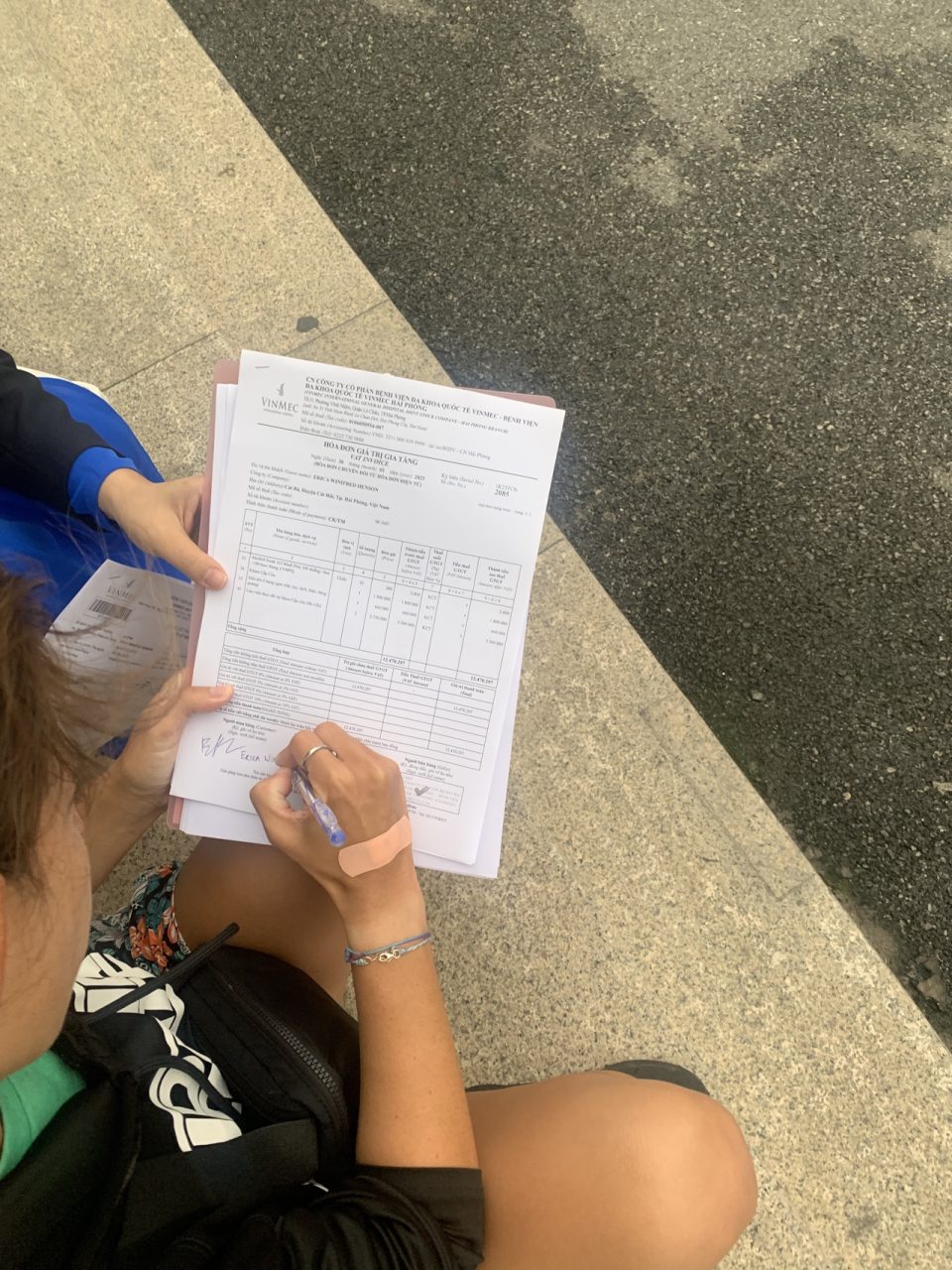

However, if you find yourself in an emergency, you should find the nearest hospital, pay upfront, and keep all the invoices and receipts for reimbursement.

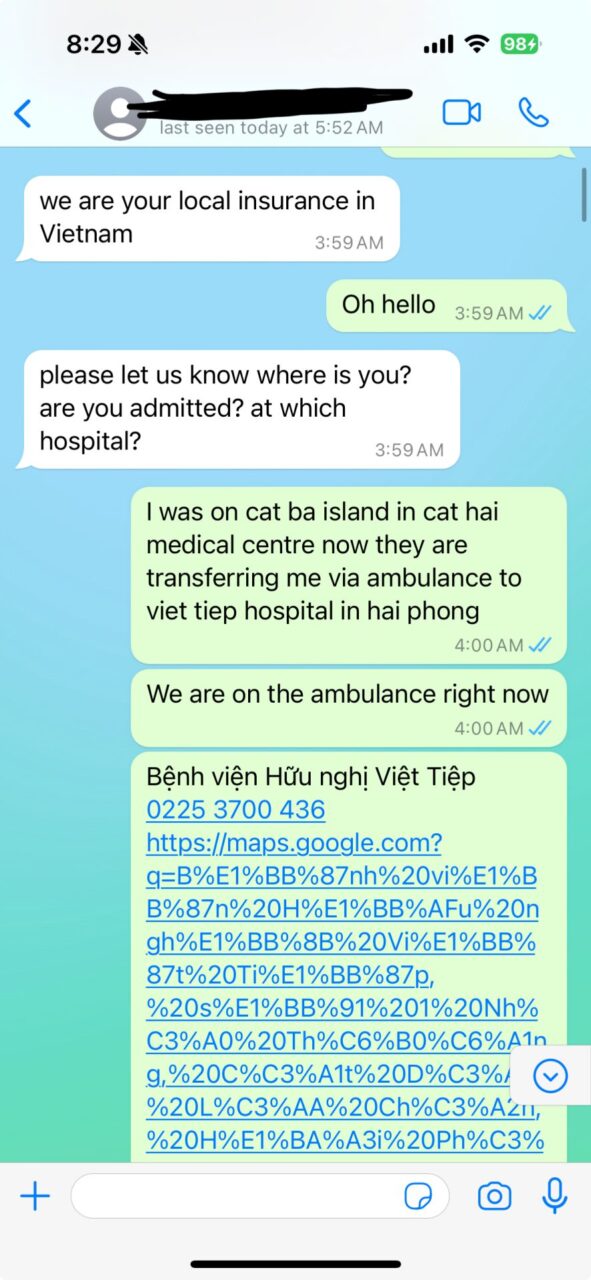

Local Partner: After I got sick and reached out to HeyMondo in Vietnam, I received a WhatsApp message from a Vietnamese man named Aap, who HeyMondo assigned as my local contact. This turned out to be a huge lifesaver because there was a massive language barrier between myself and many of the Vietnamese hospital staff, so having Aap there to deal with all the billing and help talk to my medical providers was a godsend.

Theft Coverage: Heymondo provides coverage for material losses resulting from violent or forceful robberies, but not petty theft. You must file a police report along with your claim for robbery incidents to be entitled to this coverage.

User-Friendly App: HeyMondo uses a simple app for all claims. In the app, you can easily contact customer service, submit the files for your claim, and it even includes tele-health chatting with a real doctor if you have a medical question. Heymondo also has 24/7 customer support, so you have access to real-time assistance at all times.

PERSONAL EXPERIENCE WITH HEYMONDO

While on Cat Ba Island, Vietnam, I started to have a really high fever and body aches all over. My symptoms lasted over 24 hours and I was starting to get concerned, so I reached out to HeyMondo to refer me to a local clinic. They got back to me within the hour, and assigned me to Cat Ba Hospital.

Cat Ba Hospital ran some tests, but didn’t have the capability to treat my case. I was then transferred via ambulance to a bigger hospital, VinMec Haiphong Hospital, 2 hours away.

I was diagnosed at VinMec with gastroenteritis (stomach infection) and kept overnight in the ER. Luckily, my symptoms subsided quickly with the prescribed antibiotics and I was able to leave the hospital after about 24 hours.

I was in communication with my local partner, Aap, the entire time. He helped me translate with my medical providers, deal with all of the billing, and was very communicative and responsive through the whole experience. He helped set up direct medical billing from HeyMondo to the hospital, so I got my entire ER stay and all my medicine (500+ USD) covered without paying a penny out of pocket!

Being in a foreign hospital is already a scary, and the last thing you want to be doing while sick/injured is dealing with receipts and reimbursements. HeyMondo made everything super easy, covered all my expenses, and I have nothing but good things to say about their coverage (this is not sponsored lol)!

Travelling is both exhilarating, yet unpredictable. We never know what’s gonna happen, so having HeyMondo coverage gives us that peace of mind that no matter what happens, we’ll have some insurance coverage so we’re not stuck in a bad spot.